Migrating Debt onto the Internet

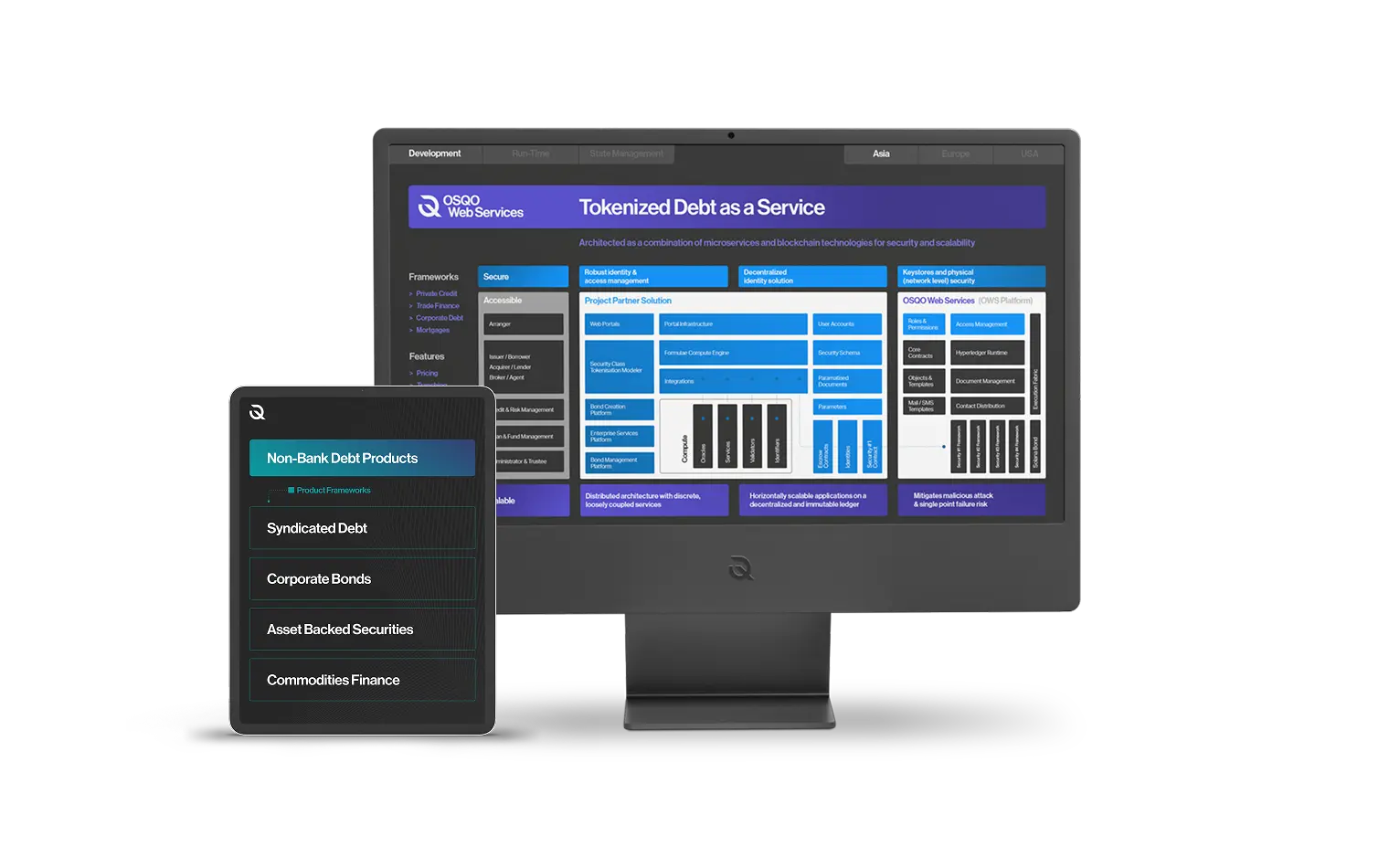

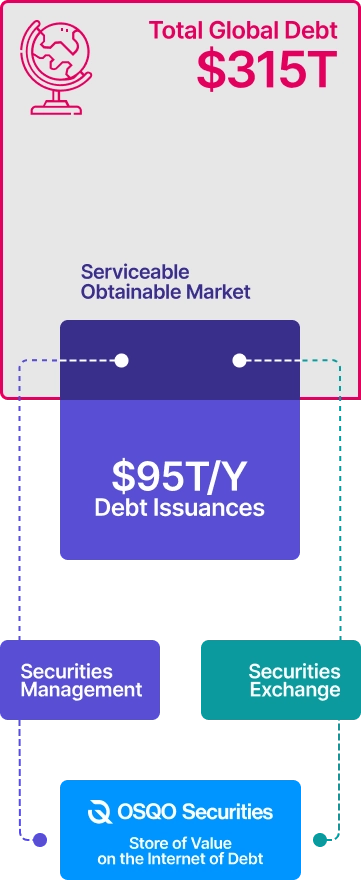

Debt is the world’s largest asset class and the final product for migration onto the Internet. Real World Debt is typically difficult to originate and cumbersome to securitize. OSQO’s Distributed Finance Token Architecture bridges Traditional Finance and Decentralized Finance to enable this migration.

Scroll to learn more